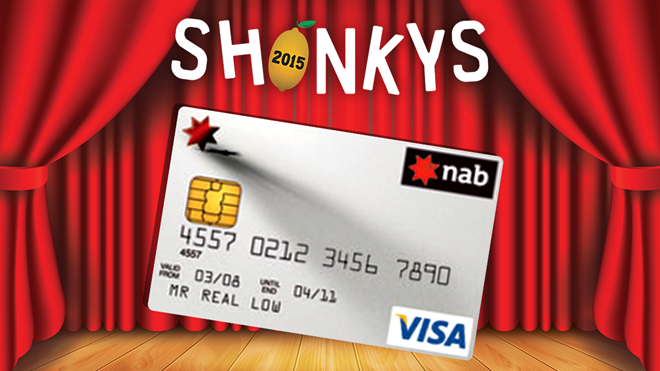

Never trust the term "low rate" when it comes from one of the big four banks, especially when it refers to credit card rates.

Although official interest rates have fallen to historically low levels since 2011 (from 4.75% in June 2011 to 2.00% more recently), NAB's credit card interest rates have headed in the other direction.

We see a contradiction there – or at least a cash grab at the expense of consumers that has a distinct whiff of shonkyness about it.

Not only did NAB fail to pass on the cash rate savings, they actually increased their "low rate" credit card interest rate from 12.99% in 2012 to 13.99% more recently.

Sure it's technically legal, but is it fair to the consumer?

Thankfully, a Senate inquiry is looking into credit card interest rates, which have been getting shonkier and shonkier in recent years.

Meanwhile, we thought a Shonky would get the message across to NAB that consumers don't like getting gouged.

And for the record, a true low rate card would hit you up for less than 10% interest, a far cry from the average of 18.98% charged by the big four banks.

Join the Shonkys conversation

Talk about lemons... Share thoughts on this year's Shonky Awards with the CHOICE community forum.